Seekingalpha.com: Tesla is positioned to be a leader in the electric vehicle market for years to come.

The gigafactory will give Tesla the ability to sustain superior profit margins.

Elon Musk is a true innovator who can lead the company to greatness.

Intro

Tesla Motors (NASDAQ:TSLA) is a very polarizing stock. Some would say that a $28 billion valuation is much too high for a company that recorded revenue of $2 billion in 2013 and $1.4 billion through the first two quarters of 2014. Assuming the trend continues, TSLA will have a price sales ratio of 11.8, which is compared to the industry average of 0.5. TSLA's forward price to earnings ratio is nearly 300. It would seem these people have a point, no?

But they are ignoring a few very important things: 1) TSLA has great position in the fledgling electric vehicle market 2) TSLA is building a lithium-ion battery factory to power its vehicles and 3) TSLA has Elon Musk. These three facts give TSLA a valuation that is well over the $28 billion it has now.

1) The Fledgling EV Market

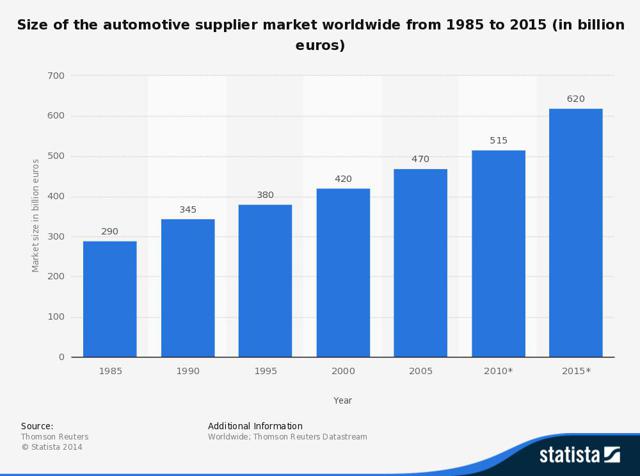

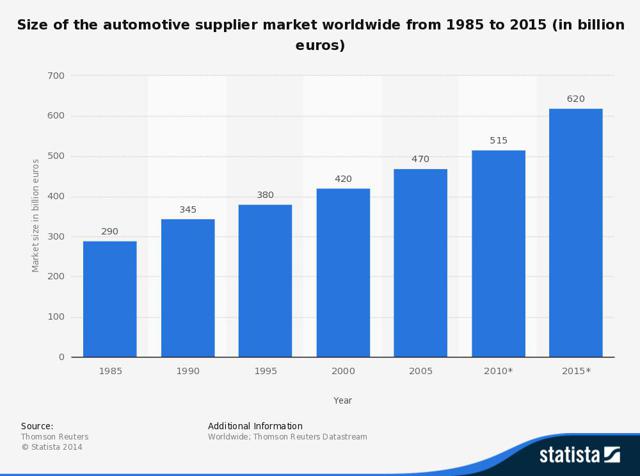

The global automotive market is estimated to reach $784 billion in 2015, and it is also estimated that by 2020, 7% of all vehicles sold will be hybrid or electric vehicles EV.

Find more statistics at Statista

Assuming the automobile market is worth $1 trillion in 2020, which is conservative considering recent growth rates in the automotive market, electric and hybrid vehicles will represent $70 billion of the market. That is a relatively tiny piece of the pie. But make no mistake: all-electric cars are the vehicles of the future. It won't happen overnight, but that $1 trillion automotive market will slowly shift away from combustion engine vehicles and become electric vehicles. That leaves TSLA and other EV manufacturers with a massive amount of market share to gain, and TSLA's brand name, sleek vehicle design, prestige and future more affordable vehicle options will ensure the company is a leader in the industry during the EV growth cycle.

It is impossible to estimate what kind of market share TSLA will see from the transition from combustion engines to battery power, but based on TSLA's current success in a market still dominated by gasoline powered vehicles, it can be safely assumed that TSLA will capture a big portion of the EV market.

You still might be skeptical about the $28 billion market cap or about how TSLA will fare in an increasingly competitive industry. The gigafactory and Elon Musk solve both of those problems.

2) Gigafactory and 3) Musk

The gigafactory is perhaps the most exciting thing to look forward to if you believe in TSLA's future prospects. This factory will give TSLA near complete vertical integration and will therefore drastically lower TSLA's cost of revenue, raising profit margins. The company expects the gigafactory to reduce the cost of producing lithium-ion batteries by a minimum of 30%.

With the factory producing lithium-ion batteries, electric motors and powertrains for TSLA's vehicles, and with the direct selling model that the company uses to sell its vehicles, the company will be almost completely independent. But not only will the factory produce EV components for TSLA's vehicles, this factory is intended to manufacture parts for other EV makers as well. This will position TSLA to be both a leader in producing vehicles for the EV market and a leader in supplying components for the market. The gigafactory was an aggressive and innovative idea that will certainly help to establish the company in the EV market in the future. Now even if you still believe the company is overvalued, having Elon Musk at the helm almost guarantees the company's success.

Musk is often compared to Henry Ford because both are associated with revolutionizing the auto industry. However, Musk is not only a businessman; he is also a scientist. Personally, I don't think Musk can be compared to anybody. He is truly unique in his approach to business. He announced that TSLA would allows other companies to use its patents so that EV cars can be integrated more quickly into the automotive industry. Musk has also said that the idea for TSLA and SCTY came about because of Musk's concern for global warming.

This is a man who cares about humanity and sees his companies as a way of helping people to improve the Earth and the human race. Musk risked his company's competitive advantage by opening up its patents, in the name of stopping global warming. I am not so naive to think that global warming is the only reason for him to do this, but I do think that it was a big factor in his decision. With a man like this in charge of a revolutionary company, the possibilities are endless. Musk is the visionary leader of a visionary company. I don't think that's a coincidence. Elon Musk has set his sights on changing the world and if his companies are the tools he'll use, those are companies I'd invest in.

The gigafactory will give Tesla the ability to sustain superior profit margins.

Elon Musk is a true innovator who can lead the company to greatness.

Intro

Tesla Motors (NASDAQ:TSLA) is a very polarizing stock. Some would say that a $28 billion valuation is much too high for a company that recorded revenue of $2 billion in 2013 and $1.4 billion through the first two quarters of 2014. Assuming the trend continues, TSLA will have a price sales ratio of 11.8, which is compared to the industry average of 0.5. TSLA's forward price to earnings ratio is nearly 300. It would seem these people have a point, no?

But they are ignoring a few very important things: 1) TSLA has great position in the fledgling electric vehicle market 2) TSLA is building a lithium-ion battery factory to power its vehicles and 3) TSLA has Elon Musk. These three facts give TSLA a valuation that is well over the $28 billion it has now.

1) The Fledgling EV Market

The global automotive market is estimated to reach $784 billion in 2015, and it is also estimated that by 2020, 7% of all vehicles sold will be hybrid or electric vehicles EV.

Find more statistics at Statista

Assuming the automobile market is worth $1 trillion in 2020, which is conservative considering recent growth rates in the automotive market, electric and hybrid vehicles will represent $70 billion of the market. That is a relatively tiny piece of the pie. But make no mistake: all-electric cars are the vehicles of the future. It won't happen overnight, but that $1 trillion automotive market will slowly shift away from combustion engine vehicles and become electric vehicles. That leaves TSLA and other EV manufacturers with a massive amount of market share to gain, and TSLA's brand name, sleek vehicle design, prestige and future more affordable vehicle options will ensure the company is a leader in the industry during the EV growth cycle.

It is impossible to estimate what kind of market share TSLA will see from the transition from combustion engines to battery power, but based on TSLA's current success in a market still dominated by gasoline powered vehicles, it can be safely assumed that TSLA will capture a big portion of the EV market.

You still might be skeptical about the $28 billion market cap or about how TSLA will fare in an increasingly competitive industry. The gigafactory and Elon Musk solve both of those problems.

2) Gigafactory and 3) Musk

The gigafactory is perhaps the most exciting thing to look forward to if you believe in TSLA's future prospects. This factory will give TSLA near complete vertical integration and will therefore drastically lower TSLA's cost of revenue, raising profit margins. The company expects the gigafactory to reduce the cost of producing lithium-ion batteries by a minimum of 30%.

With the factory producing lithium-ion batteries, electric motors and powertrains for TSLA's vehicles, and with the direct selling model that the company uses to sell its vehicles, the company will be almost completely independent. But not only will the factory produce EV components for TSLA's vehicles, this factory is intended to manufacture parts for other EV makers as well. This will position TSLA to be both a leader in producing vehicles for the EV market and a leader in supplying components for the market. The gigafactory was an aggressive and innovative idea that will certainly help to establish the company in the EV market in the future. Now even if you still believe the company is overvalued, having Elon Musk at the helm almost guarantees the company's success.

Musk is often compared to Henry Ford because both are associated with revolutionizing the auto industry. However, Musk is not only a businessman; he is also a scientist. Personally, I don't think Musk can be compared to anybody. He is truly unique in his approach to business. He announced that TSLA would allows other companies to use its patents so that EV cars can be integrated more quickly into the automotive industry. Musk has also said that the idea for TSLA and SCTY came about because of Musk's concern for global warming.

This is a man who cares about humanity and sees his companies as a way of helping people to improve the Earth and the human race. Musk risked his company's competitive advantage by opening up its patents, in the name of stopping global warming. I am not so naive to think that global warming is the only reason for him to do this, but I do think that it was a big factor in his decision. With a man like this in charge of a revolutionary company, the possibilities are endless. Musk is the visionary leader of a visionary company. I don't think that's a coincidence. Elon Musk has set his sights on changing the world and if his companies are the tools he'll use, those are companies I'd invest in.